MODULAR OR MANUFACTURED HOME LOANS

Veteran Owned Mortgage Broker in Colorado Springs

Purchasing a home may be the best investment you can make for your future. However, before you buy a home, it’s vital to determine what type of home and home loan suits your needs. A modular or manufactured home may be the best choice for you compared to a traditional, on-site build.

Colorado Springs, in particular, has many new neighborhoods dedicated to manufactured and modular homes. This new home type is a popular option for people looking for an affordable, low-maintenance, and convenient primary residence. Therefore, understanding the difference between modular and manufactured homes and the loans associated with each home type is essential.

The Reichert Mortgage Team connects home buyers with manufactured and modular home loans. As a Colorado Springs mortgage broker, we can provide you with the right financial program for your needs. Learn more about manufactured home loans here, and contact us today for questions about this great loan option.

What Is The Difference Between Modular and Manufactured Homes?

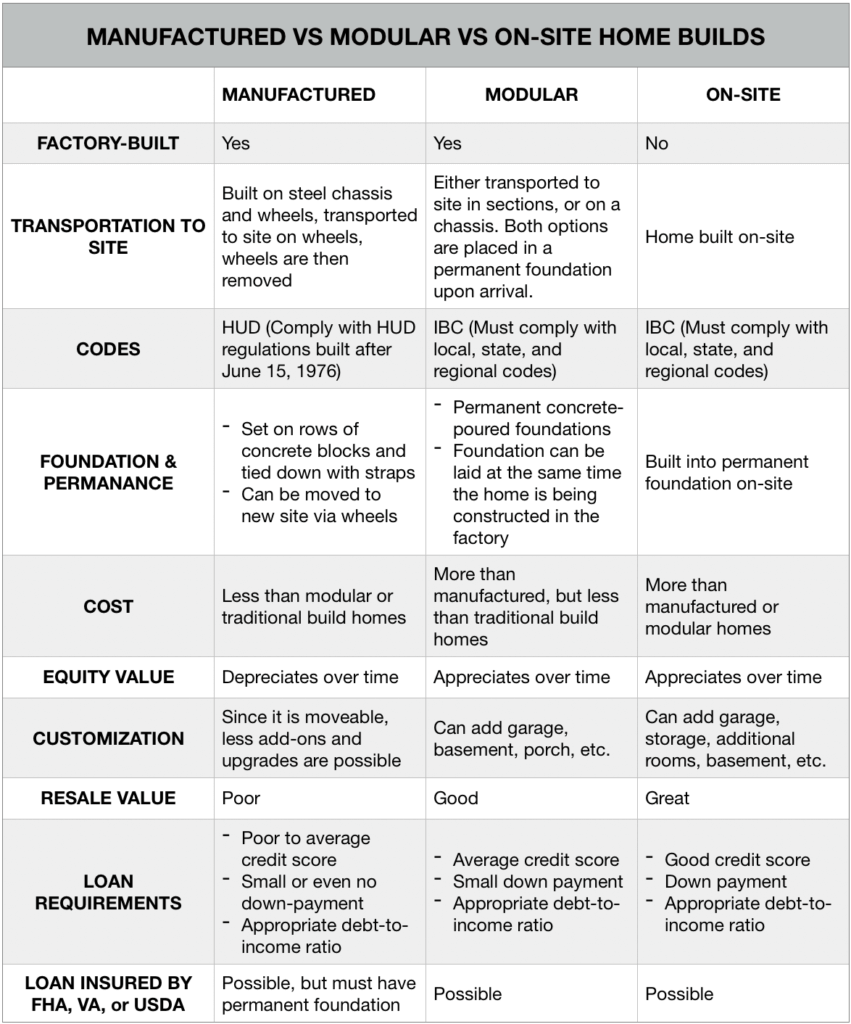

Many people use the terms manufactured or modular homes interchangeably. Still, it is important to note the differences between both options, so you know you are investing in the right home type. Both are factory-built homes, but differences include housing codes, permanence, building options, and resale values.

For example, manufactured homes are a good option for those with a less-than-perfect credit history and are often referred to as mobile homes. Modular homes are better for those with fair credit who want to stretch their dollar more than they could with an on-site build. Take a look at your financial past and future preferences to make a decision that is best for you. Here at The Reichert Mortgage Team, we can help you through a process like this!

Pros and Cons of Manufactured Homes Vs. Modular Homes Vs. On-Site Builds

Manufactured and modular homes are a more affordable option for families looking to buy a new home or invest in real estate. They typically require a smaller down payment, but manufactured home loan rates can be higher than a traditional mortgage.

Of the two, manufactured homes require the lowest down payment and credit score, but they also tend to depreciate over time. A manufactured home, therefore, may not be the best long-term investment if you plan to resell.

For a complete comparison of pre-built vs. on-site homes, check out the table below:

Types of Mortgages for Modular Homes and Manufactured Homes

Modular and manufactured homes aren’t always eligible for the same types of loan programs as on-site homes. Manufactured homes, for example, are not considered “real property” since they can be easily relocated. Modulars are more permanent and may be easier to secure a conventional loan for. Here are a few financing options that manufactured and modular homes are eligible for:

Chattel loans and personal loans aren’t usually used for housing but can be used as a mobile home loan. Since manufactured homes cost less and aren’t always attached to a foundation, you have a bit more flexibility. If you want to learn more about each loan type, we’d love to review the benefits and requirements with you.

LEARN ABOUT MORTGAGES

Military Appreciation Week at the Zoo

With five military bases in Colorado Springs, you don’t have to go far to run into a veteran or active service member. Our local businesses

VA Loan Documents Checklist: What to Bring

Whether it is a VA home loan or a conventional mortgage, many people have their home loan applications denied because of missing documents or unsigned

VA Loan Eligibility Requirements

A VA loan is one of the most beneficial aspects of serving in the U.S. military. It is accessible to eligible veterans, service members, and