VA HOME LOANS

VA-Approved Mortgage Broker in Colorado Springs

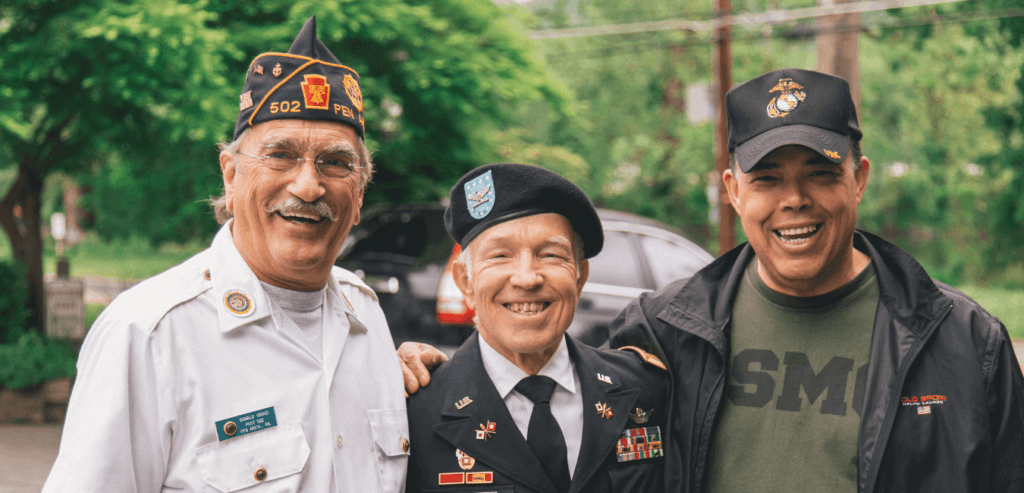

LOANS FOR THOSE WHO SERVE

VA home loans help military service members and veterans achieve homeownership. For many active duty and retired military personnel, VA loans offer better terms than other traditional home loan programs. A VA home loan is a zero-dollar down loan program with benefits like lower interest rates, no requirements for mortgage insurance, and higher approval for low credit scores. VA loans help to make homeownership possible for active and former service members across the United States.

At the Reichert Mortgage Team, we proudly serve Colorado Springs as a VA-approved mortgage broker. We are honored to give back to the large military community in southern Colorado through our VA home loan program. As a veteran-owned mortgage broker, the Reichert Mortgage Team is dedicated to serving the individuals who have done the same for our country. From your loan application to your closing date, the Reichert Mortgage Team is here to help you every step of the way on your path to homeownership.

What Are VA Loans?

Introduced in 1944, VA home loan programs were established to help service members purchase homes after returning from active duty. VA loans are still one of the best opportunities for military personnel and their families to buy a home today.

Backed by the U.S. Department of Veterans Affairs, VA loans help active-duty military, retired military members, and surviving spouses to buy, build, repair, retain, or adapt a home. VA home loans are issued by approved mortgage companies to assist military service members to buy single-family homes, condominiums, multi-unit properties, manufactured homes, and new construction builds.

Benefits of VA Loans

VA home loans offer many benefits to make homeownership accessible to active duty military, veterans, and their families. At the Reichert Mortgage Team, we are dedicated to serving you on your journey toward homeownership. Our goal is to match you with the best mortgage rate with the best benefits. Some of the benefits of a VA home loan include:

- No down payment requirements

- Competitive interest rates

- No private mortgage insurance requirements

- No early loan pay-off penalties

- Higher approval for lower credit scores

VA Loan Eligibility Requirements

VA home loans are available to active military and retired military members, as well as military spouses in special circumstances. To be eligible for a VA loan, individuals must meet the following criteria:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

- Served six years of service in the National Guard or Reserves

- Unmarried spouse of a service member who has died in the line of duty or from a service-related disability

VA Home Loan Process

At the Reichert Mortgage Team, we are the best VA loan lender in Colorado Springs. Our brokers are happy to help you start your VA loan application and answer any questions you have. We are here to provide you with the highest quality resources and knowledge on the VA home loan process. From helping you throughout the loan application to assisting you to obtain a Certificate of Eligibility, the Reichert Mortgage Team is passionate about helping you buy your dream home. To be approved for a VA loan, we look at the following information:

- Certificate of Eligibility

- Employment information from the past two years

- Tax information from the past two years

- Banking accounts

- Credit information

Veteran Resources

Resource Center for Veterans

As a veteran-owned and operated mortgage brokerage, the Reichert Mortgage Team is proud to give back to the military community in Colorado Springs. We are passionate about working with service members to provide support to them and their families. This is why our team has curated our Resource Center for Veterans to ensure our retired military community has all the resources they need.

The Reichert Mortgage Team Blog

The Reichert Mortgage Team blog is the perfect resource to read more about VA home loans. From our guide to VA loans, VA appraisal checklist, and our blog about refinancing a VA loan, the Reichert Mortgage Team is here to provide the highest quality VA home loan information. Our blog offers free mortgage education so you always have the resources necessary to achieve your goal of homeownership.

Pikes Peak Heroes

At the Reichert Mortgage Team, one of our top priorities is to give back to our community. This is why we have created the Pikes Peak Heroes Program to offer our community members benefits when it comes to purchasing a home and closing a mortgage. The Pikes Peak Heroes Program allows the Reichert Mortgage Team to give back to military members across our community.

Get Started on Your VA Loan Today With the Reichert Mortgage Team

VA loans can help active duty service members and veterans achieve homeownership. At the Reichert Mortgage Team, we are proud to be your local, veteran-owned mortgage broker in Colorado Springs.

We have a passion for serving military members, and we specialize in VA home loans to assist active and retired military personnel buy their dream homes. Our team knows exactly how to get you the best loan for your unique situation. When you work with the Reichert Mortgage Team, you get a partner in your VA loan.